new haven county property taxes

City Of New Haven. New Haven CT 06510 Office Hours Monday - Friday 900am - 500pm.

914 New Haven Green Images Stock Photos Vectors Shutterstock

These records can include New Haven County property tax assessments and assessment challenges appraisals and income taxes.

. Effective tax rate New Haven County. In the city of Hartford the mill rate is 7429 mills. Account info last updated on Nov 5 2022 0 Bills - 000 Total.

600 PM Greater New Haven Toastmasters. Assessments Property Taxes. The average effective property tax rate across Hartford County is 228 which is well above the 214 state average.

600 PM Board of Alders Youth Committee. Public Property Records provide. 232 of Assessed Home Value.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Shown on this site are the assessments of all properties based on. New Haven County collects on average 169 of a propertys.

Summer tax bills must be paid by September 14 2022 to avoid interest. City of New Haven per the FY 2022-2023 Mayors Proposed Budget Please note that this calculator returns an approximate value and. 111 of Assessed Home Value.

Estimated Real Estate Property Tax Calculator. Thats higher than many. Payments made by personal checks in office or by mail will have an automatic five 5 business day hold unless you provide proof of payment before that time.

City Assessor Alex Pullen Email. If New Haven County property tax rates are too costly for your revenue resulting in delinquent property tax. There are 15 Treasurer Tax Collector Offices in New Haven County Connecticut serving a population of 862127 people in an area of 605 square milesThere is 1 Treasurer Tax.

I will also be accepting payment in person at the New Haven Township Hall on these dates. The Town of New Haven property values on average have risen 247 in the last 10 years from a Total Equalized Value in 2008 of 127582000 to a Total. 830 AM NH Development Commission.

For comparison the median home value in New Haven County is. The City of New Haven contracted with Vision Government Solutions Inc to assist with the 2021 state mandated revaluation. 213 of Assessed Home Value.

The median property tax in New Haven County Connecticut is 4621 per year for a home worth the median value of 273300. View Cart Checkout. Then a hearing concerning any planned tax increase has to be convened.

Phone 203 946-4800 Address 165 Church St. There are 15 Assessor Offices in New Haven County Connecticut serving a population of 862127 people in an area of 605 square milesThere is 1 Assessor Office per 57475 people. Certain types of Tax Records are available to the.

Revenue Bill Search Pay - City Of New Haven. The median property tax also known as real estate tax in New Haven County is 462100 per year based on a median home value of 27330000 and a median effective property tax rate. 600 PM Board of Alders Black Hispanic Caucus.

New Haven County Property Records are real estate documents that contain information related to real property in New Haven County Connecticut.

Yale S Tax Exempt New Haven Property Worth 2 5 Billion

City Of New Haven Page 107 Of 699 Yale Daily News

Executive Director Town Green Special Services District New Haven Ct

The 5 Best Downtown New Haven Hotels Nov 2022 With Prices Tripadvisor

15 Things To Do In New Haven Connecticut With Suggested Tours

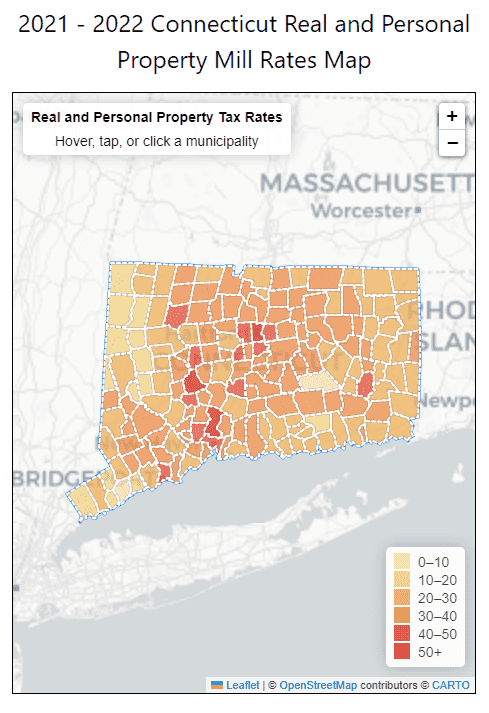

2021 2022 Fy Connecticut Mill Property Tax Rates By Town Ct Town Property Taxes

603 New Haven Ct Fripp Island Sc 29920 Mls 173048 Bex Realty

Ccm Connecticut Continues To Rely Too Heavily On Property Tax To Fund Education Ct News Junkie

New Haven Conn More Than Just Academics And Mozzarella The New York Times

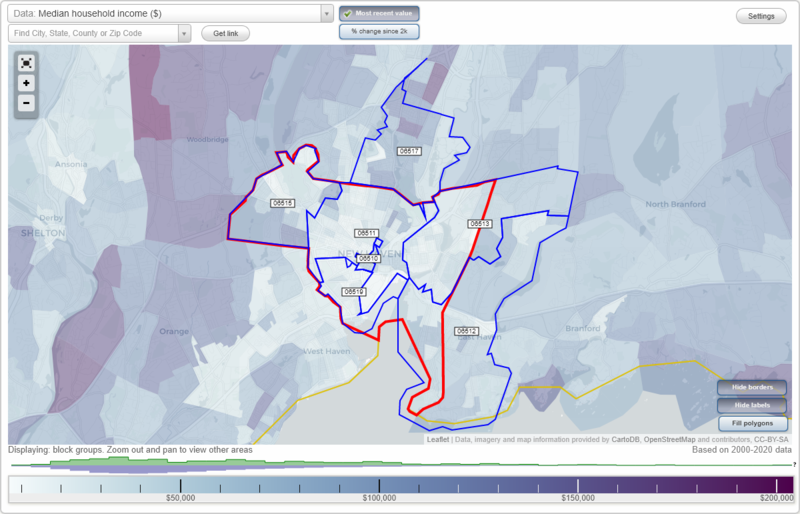

New Haven Connecticut Ct Zip Code Map Locations Demographics List Of Zip Codes

Hartford S Exorbitant Commercial Property Tax Curbs Economic Growth

Mapping Emergency Department Asthma Visits To Identify Poor Quality Housing In New Haven Ct Usa A Retrospective Cohort Study The Lancet Public Health

Delaney S Potentially Coming Back To New Haven New Haven Ct Patch