pay indiana state sales taxes

Any business meeting these qualifications must register with the Department of Revenue. Groceries and prescription drugs are exempt from the Indiana sales tax.

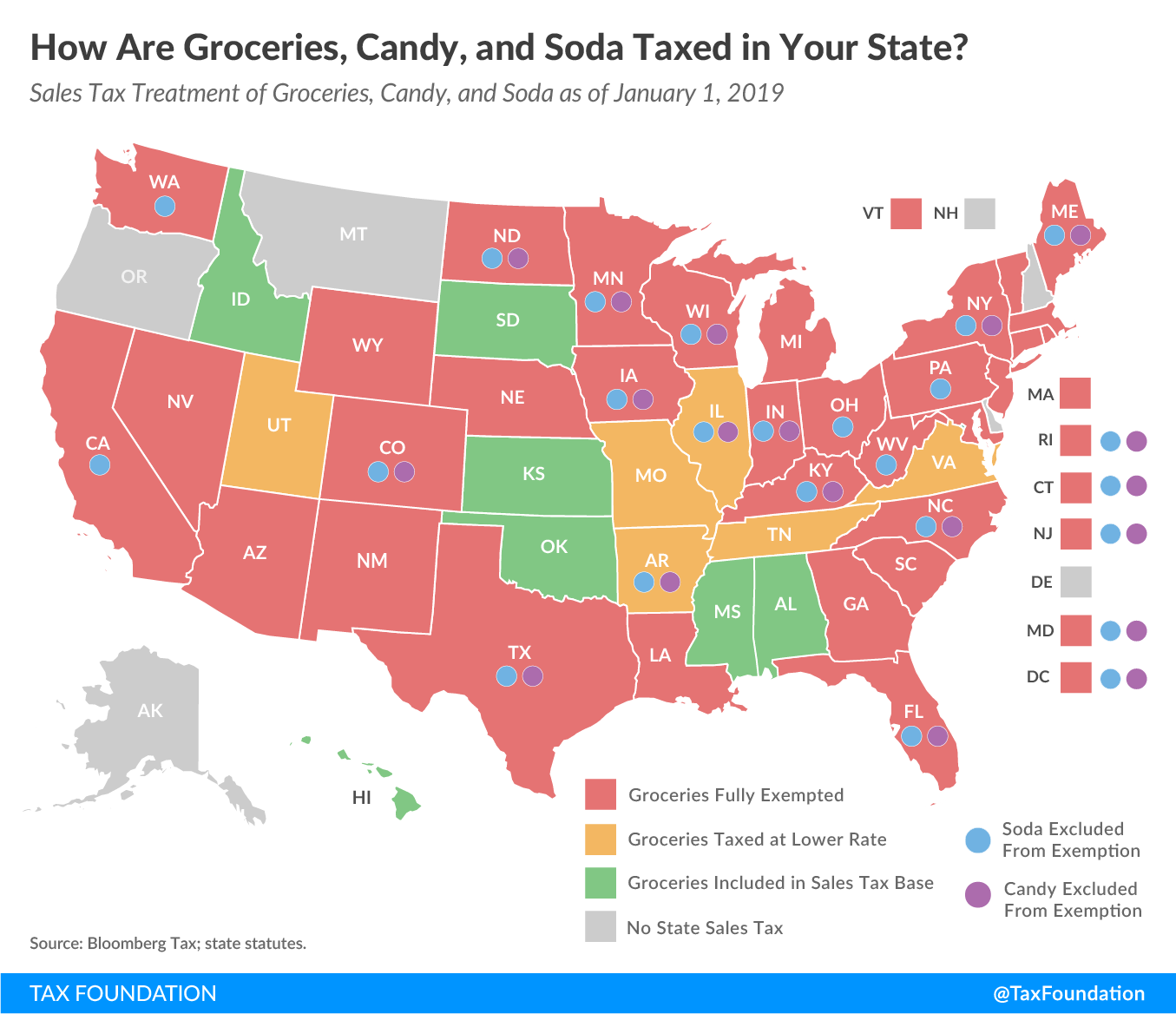

How Are Groceries Candy And Soda Taxed In Your State

This registration can be completed in INBiz.

:max_bytes(150000):strip_icc()/best-and-worst-states-for-sales-taxes-3193296_final_CORRECTED-4d56f8efcd264f53981a40415c0e6de3.png)

. The Indiana Department of Revenues DOR e-services portal the Indiana Taxpayer Information Management Engine INTIME enables customers to manage business taxes withholding. The state sales tax on a car purchase in Indiana is 7. Your browser appears to have cookies disabled.

Cookies are required to use this site. Note that Indiana law IC 6-25-2-1c requires a seller without a physical location in Indiana to obtain a registered retail merchants certificate collect and remit applicable sales tax if the. Therefore you will be required to pay an additional 7 on top of the purchase price of the vehicle.

Indiana has a statewide rate of 7 so despite where you live you just collect 7 for tax in Indiana. Sales Tax Collection Discounts In. ATTENTION-- ALL businesses in Indiana must file and pay.

Make an individual return or extension payment without logging in to INTIME. You filed your Indiana Individual income tax return and for the first time in a long time you owe a balance. Indiana is one of.

Or Completing Form ES-40 and. The state charges a 7 sales tax on the total car price at the. Indiana businesses have to pay taxes at the state and federal levels.

But for the Department of Revenue you can do it here. After your business is registered in Indiana you will. Find Indiana tax forms.

If you sell physical products or certain types of services you may need to collect retail sales tax and then pay it to the Indiana State Department of Revenue. Purchasers do not pay both sales and use taxes but one or the other. County Rates Available Online-- Indiana county resident and nonresident income tax rates are available via Department Notice 1.

Indiana does not have any local or county sales taxes so the state-wide rate of 700 applies to all applicable purchases to which sales tax must apply. For the feds youll need to register with the IRS. Indiana levies several taxes and fees in addition to its sales tax of 7 percent including a complimentary use tax.

The Indiana state sales tax rate is 7 and the average IN sales tax after local surtaxes is 7. Using a preprinted estimated tax voucher issued by the Indiana Department of Revenue DOR for taxpayers with a history of paying estimated tax. The best option is to pay the entire.

The Indiana Department of Revenue DOR offers multiple options to securely remit taxes electronically using DORs e. Indiana is an easy state in which to collect sales tax. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

This makes calculation for out of state. When you buy a car you have to pay Indiana sales tax on the purchase plus excise tax to register the vehicle. The option to make a.

Pay an Indiana Tax return through INTIME. Know when I will receive my tax refund. Check out these steps for making a payment.

Indiana Lawmakers Could Debate Sales Business Tax Changes Ap News

Indiana Lawmakers Could Debate Sales Business Tax Changes Indiana Wlfi Com

What Do I Need To Enroll In Autofile For Indiana Taxjar Support

State By State Guide To Economic Nexus Laws

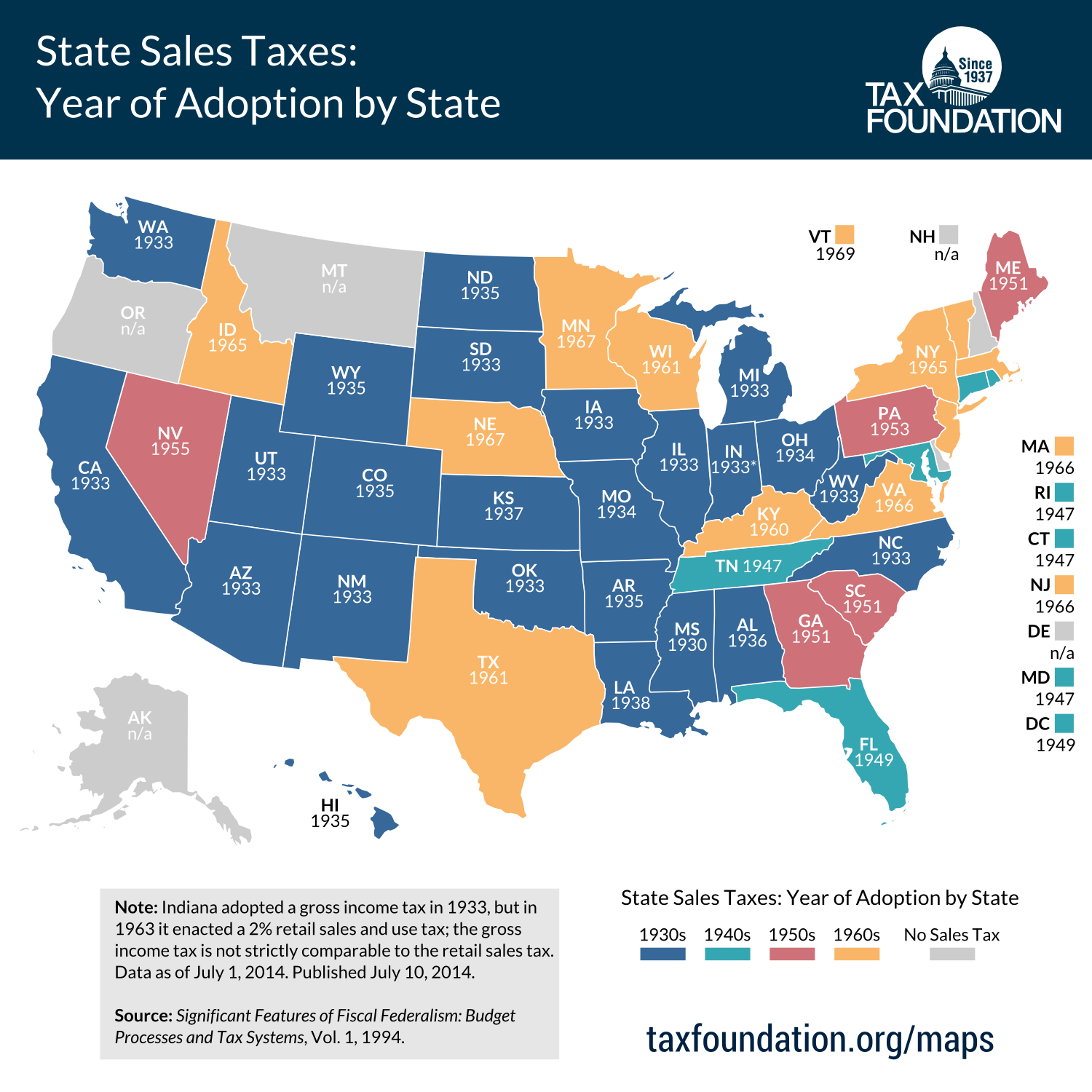

When Did Your State Adopt Its Sales Tax Tax Foundation

Sales Tax By State Is Saas Taxable Taxjar

Sales Taxes In The United States Wikipedia

What S The Car Sales Tax In Each State Find The Best Car Price

Historical Indiana Tax Policy Information Ballotpedia

Indiana Sales Tax Small Business Guide Truic

How Do State And Local Sales Taxes Work Tax Policy Center

Does Indiana Tax Its Residents More Or Less Than Other States Carroll County Comet

Sales Tax Laws By State Ultimate Guide For Business Owners

Indiana St 103 Fill Out Sign Online Dochub

How To File And Pay Sales Tax In Indiana Taxvalet

Sales Taxes In The United States Wikipedia

Sales Tax Definition How It Works How To Calculate It Bankrate